Whether you’re extending credit, securing reservations, or simply relying on a client to follow through with a payment in the future, traditional financial options like deposits, down payments, credit card holds, or ACH transfers often create delays and uncertainty around whether a financial obligation will ultimately be met. Escrow services and guaranteeing intermediaries require time, fees, dependency, and trust.

Now imagine receiving a promise that works like a cashier’s check… guaranteed, verifiable, and backed by real value, but also available instantly, with no restrictive banking hours, clearing delays, or intermediaries.

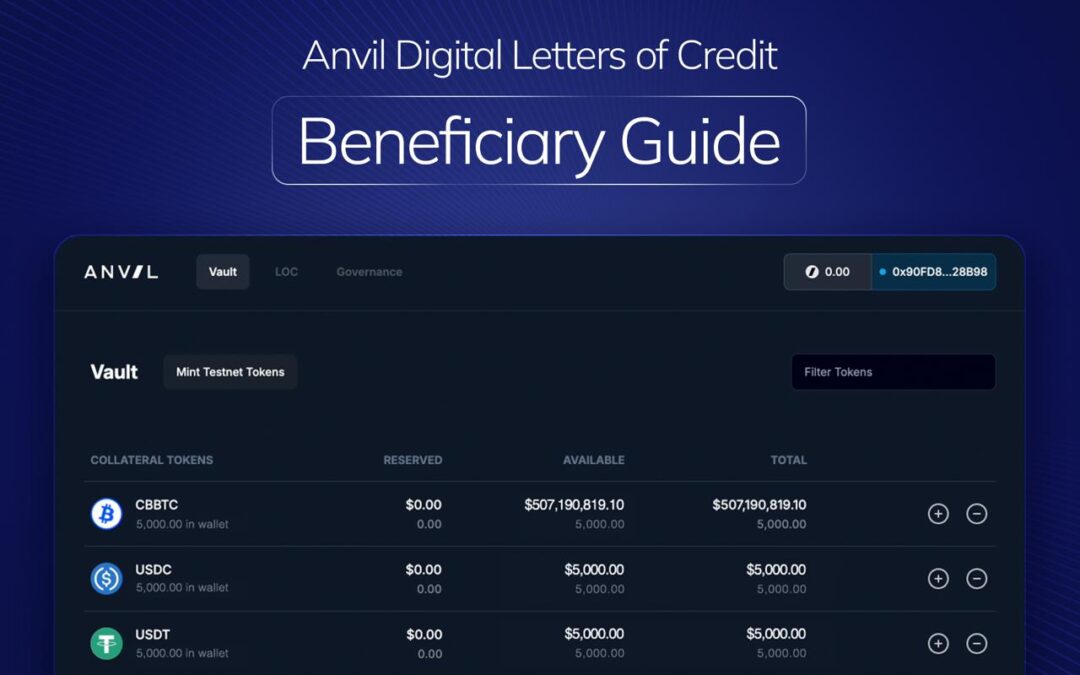

A digital Letter of Credit (LOC) makes this possible.